tax shield formula cca

You can claim the CCA for the year up to the maximum amount allowed. Income tax Rate of Return.

We therefore assume that the firms WACC is 15 the borrowing rate is given above.

. In Area A you calculate the maximum amount for column 12 by multiplying the amount in column 10 by the amount in column 11. Xl ryRate of Return Alffilfftq x 1 MAXIMIJM CAPITAL COST ALLOWANCE RATES FOR SELECTED CLASSES. The tax shields are just CCA multiplied by the corporate tax rate.

K discount rate or time value of money. C net initial investment T corporate tax rate k discount rate or time value of money d maximum rate of capital cost allowance 2. 12000 NE 95th Street 502 Vancouver WA 98682 Phone 360 694-4300.

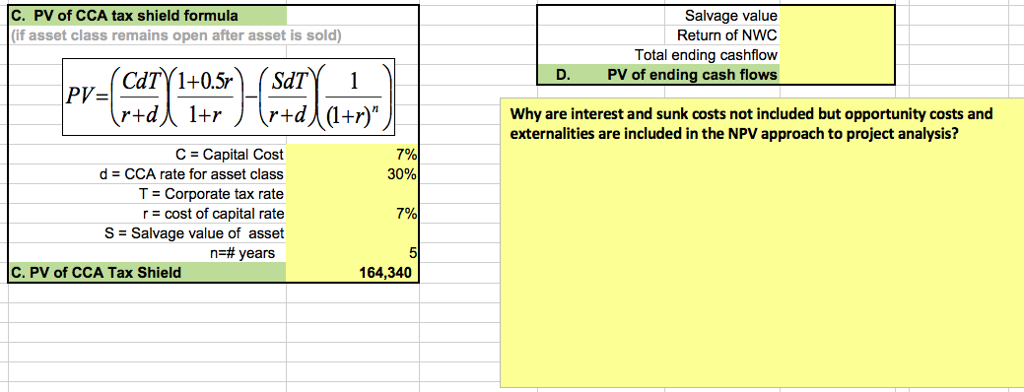

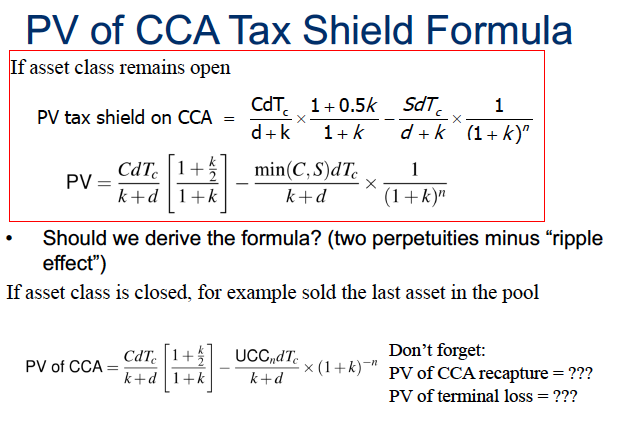

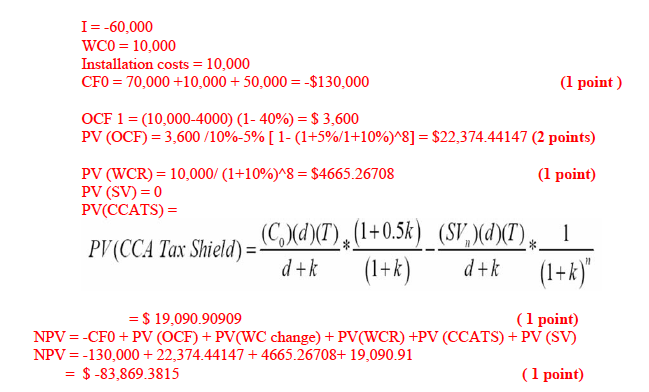

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. C net initial investment.

CCA Tax shield calculation CCATS CTD 2 K D 2 K 1 K ATCD Lost Tax Shield FV STD K D N PMT 0 I WACC CPT PV Heading centered assets and liabilities shareholders equity ATCD Indend everything under every category Blank lines. Present value of total tax shield from CCA for a new asset acquired after November 20 2018. Year n Tc be the corporate tax rate k be the opportunity cost of capital and d be the CCA depreciation rate for the relevant asset class.

As such the shield is 8000000 x 10 x 35 280000. This is equivalent to the 800000 interest expense multiplied by 35. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40.

This reduces the tax it needs to pay by 280000. Coastal Conservation Association Washington All rights reserved. Assuming the firm has other assets in this CCA class this will reduce the PV of the CCA tax shield as.

Equipment will last forever under the half-year rule. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted average cost of capital WACC. Uniform Final Exomination Report - 1997 125 TABLE III.

Interest Tax Shield Interest Expense Tax Rate. 5 The fifth item is the PV of all the future tax shields from CCA assuming the. PV of CCA tax shield CdTc k d 105k 1k UCCdTc k d 1k n.

D maximum rate of capital cost allowance. 9 now incorporate the half year rule. Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax rate 10 discount rate Year UCC CCA 5 UCC End of Year CCA Tax Shield PV Tax Shield r10 1 1000000 5 x ½ 1000000 25000 UCC beg-CCA 975000 t c x CCA 8750 t c CCA 1r 7955 2 975000 48750 926250 17063 14101 3 926250 46313 879937 16209 12178 4.

Building value 75000 total purchase price 90000 total expenses 5000 part of the expenses that can be added to the cost of the building 416667. Based on the information do the calculation of the tax shield enjoyed by the company. Google company has an annual depreciation of 10000 and the rate of tax is set at 20 the tax savings for the period is 2000.

The remaining 83333 of the total expenses relates to the purchase of the land. Enter the total CCA being claimed on line 9936 of your form. Now assume that the asset is sold for an amount at the end of year.

Consider the following formula for the present value of CCA tax shields. SELECTED PRESCRIBED AUTOMOBILE AMOUNTS. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. Tax Shield Sum of Tax-Deductible Expenses Tax rate. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITALCOST ALLOWAICE Marginal InvestmentCost Rate of Rate of. Investment Cost Marginal Rate of Income tax Rate of Capital Cost Allowance xl ry Rate of Return Alffilfftq x 1 Rate of Return MAXIMIJM CAPITAL COST ALLOWANCE RATES FOR SELECTED CLASSES. 1𝑘 Notation for above formula.

TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE Marginal Rate of Investment Rate of Cost Income tax Capital Cost Allowance Rate of Return ry xl Alffilfftq x 1 Rate of Return MAXIMIJM CAPITAL COST ALLOWANCE RATES FOR SELECTED CLASSES Class1.

T corporate tax rate. In your first year you may have to prorate your CCA claim. How to Calculate a Tax Shield Amount.

So using as the discount rate. Class1Class 3 Class 8 Class. We have a positive sign in front of it since this is cash inflow.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Class 3 Class 8 Class 9.

Tax Shield Formula How To Calculate Tax Shield With Example

The Tax Shield Approach Assuming That The Capital Chegg Com

Tax Shield Formula Step By Step Calculation With Examples

Edit This Is All The Information Provided It Is Chegg Com

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Docsity

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

Solved New Equipment Costs 845 000 And Is Expected To Last For Five Years Course Hero

Solved An Asset Has An Installed Cost Of 1 Million A Life Of 8 Years A Course Hero

13 Chapter Cash Flow Estimation Terry Fegarty Seneca College Ppt Video Online Download

Interest Tax Shield Formula And Excel Calculator

Fina 2710 Textbook Notes Summer 2019 Chapter 9 Tax Shield Net Present Value Working Capital

Q 4 6 Points Tax Shield Inc Is Considering A New Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Fin 300 Lecture Notes Fall 2016 Lecture 9 Capital Cost Allowance Tax Shield Tax Rate

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download