tax on unrealized gains bill

Sebelius 2012 the court reaffirmed that taxes on personal property are direct taxes. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on wealthy peoples unrealized capital gains.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Currently taxpayers pay tax only on realized capital gains in.

. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. According to The Wall Street Journal. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent.

Hold up wait a minute something aint right. This article is in your queue. October 25 2021.

President Biden said Friday he supports a Democratic proposal to tax billionaires annually on their unrealized investment gains. Is expected to lose almost 42 billion in tax revenue. 0000 0138.

High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. WASHINGTONA new annual tax on billionaires unrealized capital gains is. Unrealized Losses The opposite of an unrealized gain is an unrealized loss.

Unrealized capital gains are increases in value of stock purchases. With their latest tax proposal Democrats are going after an elusive target. Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis.

The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income. Requiring investors to pay taxes annually on their unrealized gains would end a longstanding rule that says levies arent due to the IRS unless an asset is sold. Once your gain is realized the amount youll pay in Capital Gains Tax depends on where you live and how long youve owned your asset.

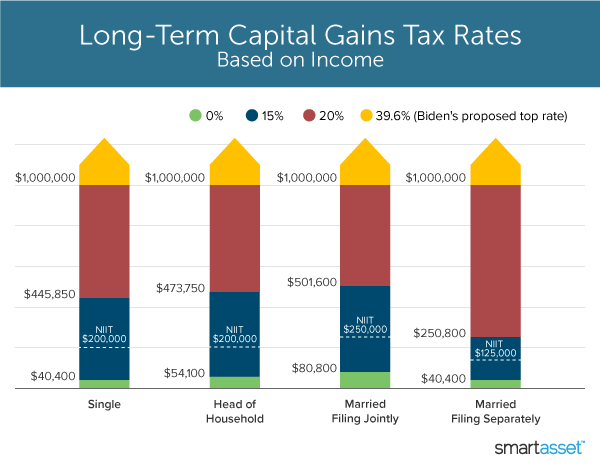

When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages. Crypto activity significantly increasing my taxes due by factors that dont add up. Sarah SilbigerBloomberg via Getty Images.

Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is. What this means is the 1000 increase in value would be taxed even though it is an unrealized capital gain that is no sale has occurred. You have a long-term realized gain of 10 and it will be subject to a tax rate of 0 15 or 20 depending on your taxable income.

The tax would apply to 1 million of that 2 million gain due to the exclusion. If the value of your investment falls after you purchase it you have a capital loss. October 25 2021 942am.

It is when a gain is realized that it is subject to Capital Gains Tax. Billionaires and their growing piles of. President Bidens 2 trillion spending package continues to stall as senior Democrats are hoping to finalize a.

How Billionaires Like Musk Could Use Options to Cover the Bill. How are unrealized gains and losses taxed. Senate Finance Chairman Ron Wyden D-Ore has pushed for years to.

Prior to adding my crypto activity into turbo tax my total taxes due was 3400. She said she expected an agreement reflecting a consensus of all 50 senators on the tax and revenue portion of the bill to emerge early this week. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains.

A tax on an increase on unrealized and of course possibly ephemeral gains is only on the most stretched of interpretations a tax on. If it passes what is the point in investing in the. The impacted assets include stocks bonds real estate and art.

A tax on unrealized capital gains would be a direct tax because its a tax on personal property paid by. I am in the 24 tax bracket married filing jointly. The tax on unrealized gains faces hurdles.

A proposed House Ways and Means bill suggests raising capital gains tax rates to a maximum of 28 percent still lower than the top rate for income tax.

What S In Biden S Capital Gains Tax Plan Smartasset

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Stop Worrying About The Unrealized Gains Tax Are You Insanely Wealthy Already No Cool Then It Doesn T Apply To You It S Fud Billionaire Fud R Superstonk

Taxing Unrealized Capital Gains A Bad Idea National Review

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Tax Strategies Using Nua For Modestly Appreciated Stock

The Top 10 Taxes And Financial Apps For Independent Contractors Onforce Small Business Accounting Financial Apps Small Business Accounting Software

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Tax Advantages For Donor Advised Funds Nptrust

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

High Class Problem Large Realized Capital Gains Montag Wealth

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Crypto Tax Unrealized Gains Explained Koinly

The Coming Tax On Unrealized Capital Gains Nomad Capitalist

Urban Catalyst S Guide To Short Term Capital Gains Tax

Bitcoin Gains Can Become Tax Free Cryptocurrency Investing In Cryptocurrency Bitcoin